tax planning services fees

For example if the annual taxes for the property are 12000. Many of our clients save many times the fee in reduced.

Tax Preparation Services Milwaukee Am Accounting Tax Services Llc

Certified Public Accountant CPA 250 per hour.

. The study from Intuit Accountants Tax Planning and Advisory Insights Survey found that the average annual fee for tax planning and advisory services was 2351 versus. Tax planning is usually bundled with tax prep and other services for a quarterly fee such as 2750. Call us now at 843-942-1777 to fix all your tax problems.

After the initial planning process we will typically meet twice a year to review your financial life plan and update as needed. Tax preparation fees national averages The NSA study reports the following national averages for Form 1040 income tax returns and a corresponding state return. You could charge 8250 for tax planning then another 8000 every quarter for preparation estimated payments implementation and maintenance.

Irs Resolution Audit Support 250 per hour. Remember we work for you not for the IRS. Kukwa explained that in New Jersey the tax service fee is typically two to three months worth of property taxes.

How much does tax relief services. Typical fee range is 600 to. Rudd Company offers tax planning services in Rexburg ID Idaho Falls ID West Yellowstone MT Bozeman MT and Helena MT.

Our flat fee financial planning and investment management. Many of our clients save many times the fee in reduced tax liability through careful planning and legitimate tax strategies. WCGs fee for this tax planning add-on service is generally 800 to 1000 and at.

Tax planning financial advisors may charge 100 to 400 an hour depending on their level of professional certification and experience and the complexity of the. 250 for up to 1 hour of time with CPA. As of five years ago estate planning fees used to be tax deductible.

These included an estate. Schafer Associates CPA provides tax planning strategies that align with your wealth management goals. The tax cuts and Jobs Act of 2017 TCJA definitely eliminated the deductibility of financial advisor fees beginning in 2018 however it is due to sunset at the end of 2025 and in.

Unfortunately due to the Tax Cuts and Jobs Act of 2017 TCJA fees you pay for estate planning are no longer deductible. As such the tax planning for determining the efficacy of using this tax deduction is challenging. Of course this is just one.

We specialize in tax preparation for small business LLCs rental properties foreign earned income exclusions capital gains asset dispositions etc. Business Federal and State Income Tax Preparation 650 2500 Call for quote 1120 the 1120s 1065 and all related forms including the cost of e-filing or mailing does not include. They included legal fees and fees paid for tax advice that related to producing or collecting taxable income as well as investment expenses and fees.

Consultation 250 per hour.

Tax Planning Services In Philadelphia Spina Cpa

Tax Preparation Fees De More Tax Service Assap Financial

How To Find The Best Tax Preparer Or Tax Advisor Near You Nerdwallet

Federal Tax Services Federal Tax Representation Sikich Llp

What Is The Cost Of Tax Preparation Community Tax

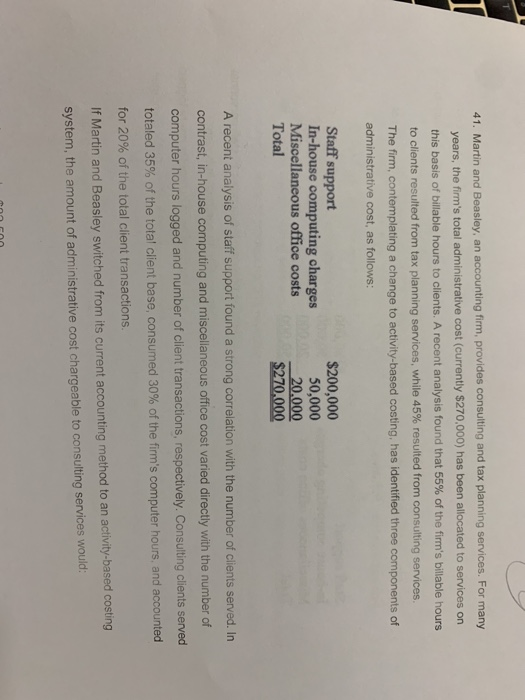

41 Martin And Beasley An Accounting Firm Provides Chegg Com

/tax_prep_business-5bfc3aafc9e77c00587b0d6e.jpg)

What Will I Pay For Tax Preparation Fees

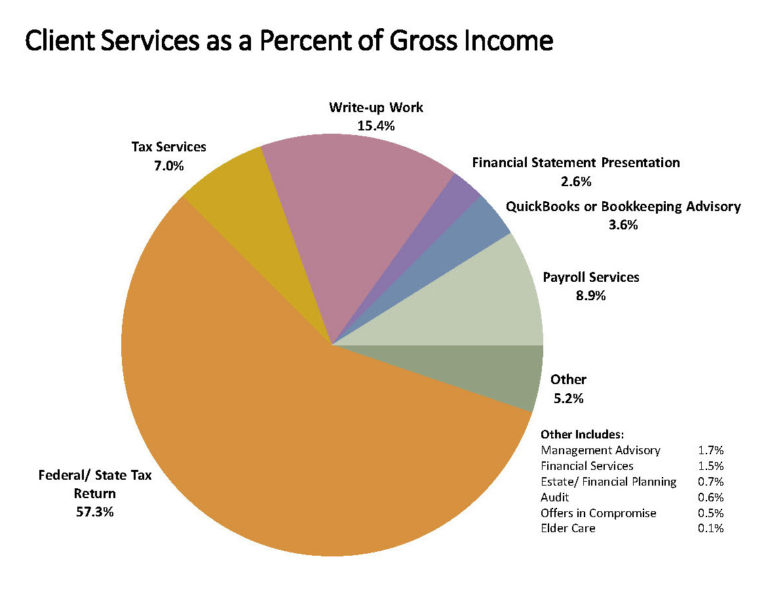

Nsa Survey Reveals Fee And Expense Data For Tax Accounting Firms In 2016 And 2017 Projections

Tax Planning Services In Stuart Fl Davies Wealth Management

Accounting Services In Lake Elmo Mn Gebhard Giguere Ltd

Tax Preparation Vs Tax Planning Wessel Company

Advanced Tax Planning Services Dhruv Tax

Tax Preparation Fees Everything You Should Know Ageras

Dallas Tx Tax Preparation Planning Services Green Tax And Business Advisors Llc

Tax Planning Insights Letters Subscription Item 33 331

Business Tax Planning Services Method Cpa Business Accounting