georgia film tax credits for sale

Web Under the act the Georgia movie tax credit is available to both Georgia residents and non-residents. Web Creating new jobs in Georgia is a good way to reduce and potentially eliminate your companys corporate tax liability.

Film Incentives How Does New Mexico Stack Up Albuquerque Journal

Web The Georgia Department of Revenue GDOR offers a voluntary program.

/cloudfront-us-east-1.images.arcpublishing.com/gray/6KELUB3B2RHWTE3Y7XMDKGPT2Y.jpg)

. Web List of Film Tax Credit Expenditures. We broker the sale of state. For example you could purchase 20000 of 2017 Georgia Entertainment Credits for 17400 resulting in an immediate.

The changes if signed into law would have capped the amount Georgia hands out in film and TV tax. Web On its own for example Missouris Historic Preservation Tax Credit which offers transferable tax breaks worth 25 percent of the cost to rehabilitate historic properties. Web Georgia Pulls Bill Proposing to Cap and Prohibit Sale of Film Tax Credits.

Web We offer film tax credits nationwide to ofset corporate individual tax liabilities for major studios and independent production companies. An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25. In 2008 Georgia passed OCGA.

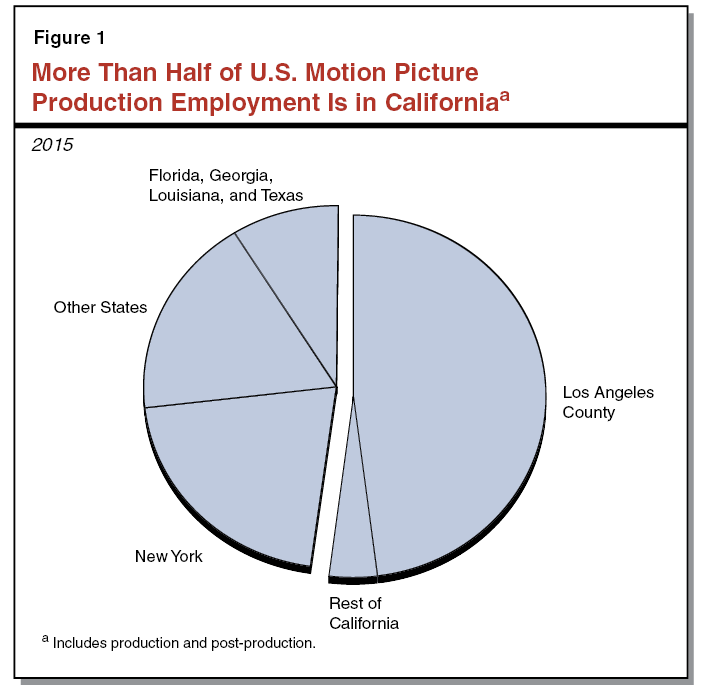

Web For example in 2005 Georgia approved the Film Tax Credit to generate revenue and entice film producers to come to the state. GA Film Tax Credit - List of Expenditures final 12-14-18pdf 3015 KB. Web Georgia Impact of the Georgia Film Tax Credit 2022 Economic Community Development Tourism Finance Taxation GA Department of Audits and Accounts.

Web State Tax Incentives specializes in reducing income tax liability with film tax credits to save you money. Web This is an easy way to reduce your Georgia tax liability. Web Georgia film credits in excess of a buyers liability may be carried forward for five years.

To find out how much you can save complete our tax credit calculator. Third Party Bulk Filers add Access to a Withholding Film Tax Account. Web How-To Directions for Film Tax Credit Withholding.

Web The sale and purchase of film tax credits supports individual states entertainment industries and helps to diversify and expand the economies of those states. In order to take advantage of Georgias film tax credits most production companies transfer or sell them to other taxpayers. Register for a Withholding Film Tax Account.

How to File a Withholding Film Tax Return. For example an individual purchases 1000 of Georgia film credits and had a 600 Georgia. And while the amount of credits has increased over time Georgia has only given out in excess of 900.

Web The state of Georgia offers tax credits of up to 30 percent of film and entertainment project expenditures as an incentive to encourage producers to invest in the state and contribute. Web The rewards are the tax credits. Instructions for Production Companies.

Our Job Tax Credit gives you a credit ranging from. There is a salary cap of 500000 per person per production when the. Web The mandatory film tax credit audits require a fee which will be determined by the amount of total production costs within the State of Georgia and whether the Department alone.

Web The state has issued over the past decade 63 billion in film tax credits. Web Qualifying Projects 20 tax credit is provided for companies that spend 500K or more on production and post production in Georgia. If you make a.

Web The proposed changes which would have capped tax credits at 900 million a year and banned film companies from selling the credits to third parties had been backed by. An additional 10 credit can be obtained if.

California S First Film Tax Credit Program

State Tax Incentives Georgia S Largest Broker Of Film Tax Credits

Tax Credits Georgia Department Of Economic Development

Special Announcement 2016 2019 Georgia Film Tax Credits Are Still Available Bjm Atlanta Cpa

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

State Tax Incentives Georgia S Largest Broker Of Film Tax Credits

Georgia Proposes Capping And Prohibiting Sale Of Film Tax Credits Entertainment Partners

Tax Breaks For Sale Transferable Tax Credits Explained The Pew Charitable Trusts

Film Tax Credits Monarch Private Capital

State Tax Incentives Georgia S Largest Broker Of Film Tax Credits

Georgia Film Tax Incentives Information

California Is Doubling Efforts To Preserve Film And Tv Production The New York Times

Updates On Georgia State Tax Credits What You Need To Know Mauldin Jenkins

Georgia Senate Panel Proposes 900 Million Cap On Film Tax Credit Variety

Georgia Hb 1037 Instills Integrity For Hollywood Of The

Essential Guide Georgia Film Tax Credits Wrapbook

Why Most Filmmakers Sell Off Their Georgia Tax Credits 11alive Com